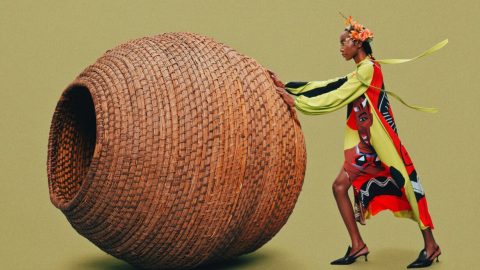

Can African fashion go green without losing its lustre?

By Annette Amollo

Africa’s fashion industry, long overshadowed by global fast fashion and second‑hand imports, is quietly evolving. A nascent but fast‑maturing segment of sustainable and ethical fashion is emerging – one that combines environmental stewardship with cultural heritage, artisan empowerment, and premium value creation. This shift, anchored in both consumer demand and conscious capital, presents distinct commercial opportunities for investors, policymakers and business leaders seeking to align profit with purpose.

A fragmented but growing market

Globally, the sustainable fashion market is on an upward trajectory, with research projecting the global sustainable fashion sector to have reached approximately KSh 1 trillion (about $7.8bn) in 2023, growing at a compound annual growth rate (CAGR) of around 9.1% through 2030. Although this figure encompasses broad apparel categories, it signals rising consumer willingness to pay premiums for transparency, ethical production and lower environmental impact.

In Africa, detailed market data remains sparse, but projections indicate sustainable clothing demand could expand significantly — with forecasts estimating the broader Africa sustainable clothing market growing from about $68.4bn in 2025 to approximately $145.7bn by 2031, at a CAGR of roughly 13.2%.

For luxury apparel specifically, Africa’s luxury fashion segment, a smaller niche within the broader industry, generated nearly $6bn in revenues in 2022, with growth expected to continue as local designers capture rising domestic and continental demand for high‑end, culturally rooted fashion.

Yet Africa’s overall share of the global fashion market remains modest, around 1.82% of a global $1.7tn sector, underscoring both a gap and an opportunity for expansion.

Drivers of demand: Conscious consumers and cultural capital

Across Africa’s urban middle classes and diaspora markets, demand for sustainable, authentic fashion is strengthening:

- Millennial and Gen Z consumers increasingly weigh ethical credentials and environmental impact in purchasing decisions, nudging brands to foreground traceability, local production and social value.

- Cultural resonance, garments that reflect local aesthetics and artisanal heritage, differentiates African sustainable fashion from global luxury imports, creating distinct brand identities that resonate internationally.

- Events such as Nairobi Fashion Week have spotlighted sustainability, showcasing designers using recycled and upcycled materials while advocating for policies that support ethical fashion growth.

This shift is not merely aesthetic. In Kenya, for instance, fashion artisans trained with support from the International Trade Centre’s Ethical Fashion Initiative, a programme that connects small‑scale producers with global markets, are being equipped to scale quality production and integrate circular design principles into export‑ready products. Some 2,500 creators from marginalized communities are expected to benefit from this initiative, gaining access to international fashion firms and improved working conditions.

From Mitumba to upcycling: Redefining value chains

Kenya illustrates the paradox facing sustainable fashion proponents. Imported second‑hand clothing, locally known as “mitumba”, dominates the apparel ecosystem — with estimates of nearly 500 shipping containers arriving monthly through the Port of Mombasa, supporting livelihoods yet generating waste and environmental harm.

Against this backdrop, upcycling and circular design are gaining footholds:

- Nairobi‑based initiatives such as Artisan Fashion repurpose textile waste, embedding circularity into production and linking local artisans with high‑end international fashion houses.

- Local brands are innovating with recycled materials, indigenous fibres and plant‑based dyes, reducing waste and energy use while preserving artisanal techniques.

These efforts align with global trends in sustainable luxury, where eco‑credentials and ethical labour practices increasingly influence premium pricing and brand loyalty.

Spotlight on Brand Innovators

Africa’s sustainable luxury fashion ecosystem remains concentrated among agile, purpose‑driven designers and social enterprises:

- SOKO Kenya combines eco‑friendly material use with artisan employment and skills training, partnering with global brands to cement Kenya’s presence on international luxury platforms.

- Katush, Hamaji and other Kenyan labels integrate eco‑conscious inputs — from hyacinth packaging to upcycled textiles — into their value chains, evidencing a move toward slow, transparent fashion.

- Cross‑border brands such as Manyatta Belts blend Maasai beadwork with contemporary design, reinforcing how cultural heritage can underpin premium sustainable products.

These brands exemplify what analysts describe as “slow fashion” – prioritising durable, ethically made products over fast, disposable trends.

Challenges to scaling impact

Despite promise, significant barriers remain:

1. Supply Chain Fragmentation

Limited local raw material production and reliance on imports impede cost competitiveness and scalability of sustainable brands.

2. Capital Access

Small designers often lack access to growth capital and export infrastructure, leading to a crowded micro‑enterprise segment that struggles to reach premium markets.

3. Market Awareness and Price Sensitivity

Conscious consumers may desire sustainability, but price sensitivity in African markets, shaped by income constraints and the prevalence of low‑cost imports, tempers demand for higher‑priced ethical fashion.

Policy imperatives and strategic levers

To unlock Africa’s potential as a sustainable fashion hub, a coherent ecosystem strategy is required:

- Trade facilitation and export support can help designers access global fashion circuits.

- Standards and certifications for sustainable practices will build consumer trust and attract impact capital.

- Integration of circular economy principles into national industrial policies will reduce waste and strengthen local value chains.

A niche poised for purposeful growth

Sustainable luxury fashion in Africa remains a niche – modest in current economic footprint but rich in cultural capital and growth potential. The convergence of conscious consumerism, artisan empowerment and circular design presents a compelling value proposition for investors and policymakers who recognise that fashion’s future is not just about aesthetics but about ethics, resilience and inclusive growth.

For stakeholders in Africa’s creative economies, the question is no longer if sustainable fashion will scale – but how to build the enabling infrastructure, finance and markets to ensure it thrives equitably and sustainably.